|

Publication 502 (2009), Medical and Dental Expense

|

|

|

(Including the Health Coverage Tax Credit)

For use in preparing 2009 Returns Table of Contents

Table of Contents Standard mileage rate. The standard mileage rate allowed for operating expenses for a car when you use it for medical reasons is 24 cents per mile for 2009. See Transportation under What Medical Expenses Are Includible. COBRA continuation coverage. If you involuntarily lost your job between September 1, 2008, and December 31, 2009, you may qualify for a 65% reduction in premiums for COBRA continuation coverage for up to nine months. The premium reduction is not included in your gross income. You cannot claim the health coverage tax credit for any month that you receive this premium. Also, certain TAA-eligible and PBGC recipients qualify for an extension of COBRA benefits.For more information, see COBRA Premium Assistance , later. Health coverage tax credit. The health coverage tax credit (HCTC) is increased to 80% of your premium for qualified health insurance for eligible coverage months beginning after April 30, 2009, and before 2011. The increase also applies to the advance payment of credit for health insurance costs under the advance payment program.For eligible coverage months beginning in 2010, the HCTC will continue to apply to family members after certain events. Eligibility for Medicare. Once you, the eligible individual, qualify for Medicare, the HCTC will be determined for your qualifying family members for 24 months from the month you first qualify for Medicare. Divorce. If you, the eligible individual, and your spouse are divorced, your spouse will continue to be an eligible individual for 24 months from the date the divorce is finalized. Only family members who were qualifying family members immediately before the divorce was final qualify for this extension. Death. In the case of the death of the eligible individual, the spouse and other qualifying family members who qualified immediately before the death of the qualifying individual will be treated as an eligible individual for 24 months from the date of death. The HCTC does not apply to months beginning after December 31, 2010.For more information, see Health Coverage Tax Credit , later.

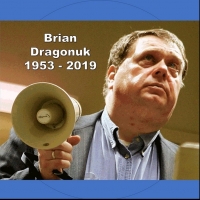

Photographs of missing children. The Internal Revenue Service is a proud partner with the National Center for Missing and Exploited Children. Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. You can help bring these children home by looking at the photographs and calling 1-800-THE-LOST (1-800-843-5678) if you recognize a child. This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A (Form 1040). It discusses what expenses, and whose expenses, you can and cannot include in figuring the deduction. It explains how to treat reimbursements and how to figure the deduction. It also tells you how to report the deduction on your tax return and what to do if you sell medical property or receive damages for a personal injury. Medical expenses include dental expenses, and in this publication the term “medical expenses” is often used to refer to medical and dental expenses. You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). If your medical and dental expenses are not more than 7.5% of your AGI, you cannot claim a deduction. This publication also explains how to treat impairment-related work expenses, health insurance premiums if you are self-employed, and the health coverage tax credit that is available to certain individuals. Pub. 502 covers many common medical expenses but not every possible medical expense. If you cannot find the expense you are looking for, refer to the definition of medical expenses under What Are Medical Expenses . See How To Get Tax Help near the end of this publication for information about getting publications and forms. Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions.

You can write to us at the following address:

We respond to many letters by telephone. Therefore, it would be helpful if you would include your daytime phone number, including the area code, in your correspondence. You can email us at *taxforms@irs.gov. (The asterisk must be included in the address.) Please put “Publications Comment” on the subject line. Although we cannot respond individually to each email, we do appreciate your feedback and will consider your comments as we revise our tax products.

Ordering forms and publications. Visit www.irs.gov/formspubs to download forms and publications, call 1-800-829-3676, or write to the address below and receive a response within 10 days after your request is received.

Tax questions. If you have a tax question, check the information available on www.irs.gov or call 1-800-829-1040. We cannot answer tax questions sent to either of the above addresses.

Publication

Forms (and Instructions)

|

|

|